The United States Office of Government Ethics (OGE) has just issued a legal advisory that requires senior government officials to disclose NFT investments. While it primarily targets NFTs linked to “property” such as real estate, senior government officials may still need to disclose NFTs worth more than $1,000.

What we know so far

According to the United States Office of Government Ethics (OGE), all NFT investments worth $1,000 or more must be reported. The OGE’s latest advisory refers to NFTs held for investment or money-making purposes. Moreover, if these senior US government officials made $200 or more from NFTs, they must inform the federal agency.

“Public financial disclosure filers must also disclose purchases, sales, and exchanges of collectible NFTs and F-NFTs that qualify as securities,” says the legal advisory. The boundary between personal and profitable NFTs is still a bit murky. This is because the USOGE previously reported that personal assets and their corresponding NFTs do not have to be reported.

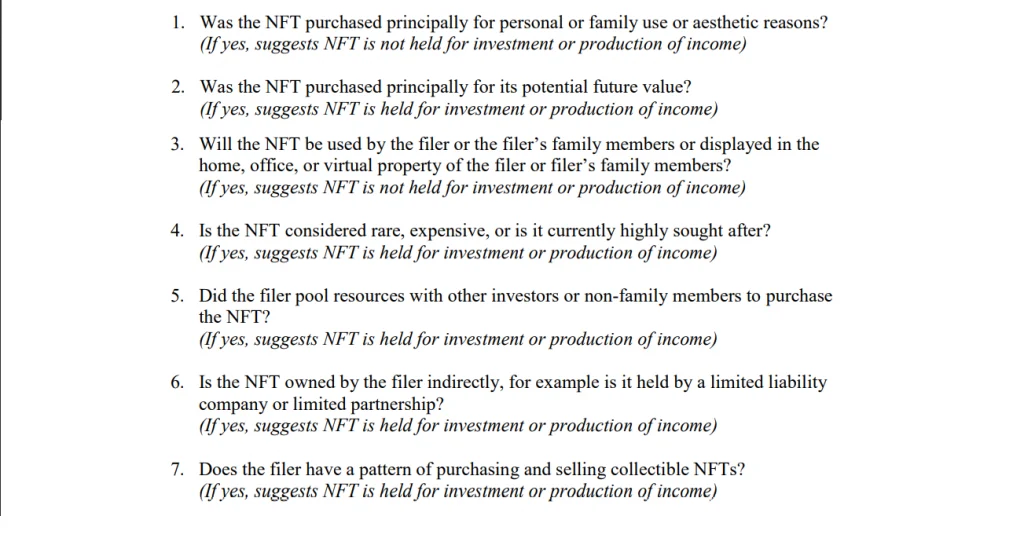

To help senior US government officials identify which NFTs to report, the OGE included seven questions to help them self-report NFTs. Filers must use OGE Form 278e to disclose their NFT investments. Along with the form, they must publish details such as the value and income of the NFTs

Source: oge.gov

US institutions’ stance on NFT investments

While certain sectors are embracing FTs, others are warier. In June, the New York Court approved the use of NFTs to serve legal documents. Conversely, this week, anti-crypto Congressman Brad Sherman encouraged the Securities and Exchange Commission (SEC) to pursue crypto exchanges. One thing is for sure, politicians and government agencies are still trying to come to terms with how crypto and NFT investments will affect the conventional financial and banking system.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.